Execution

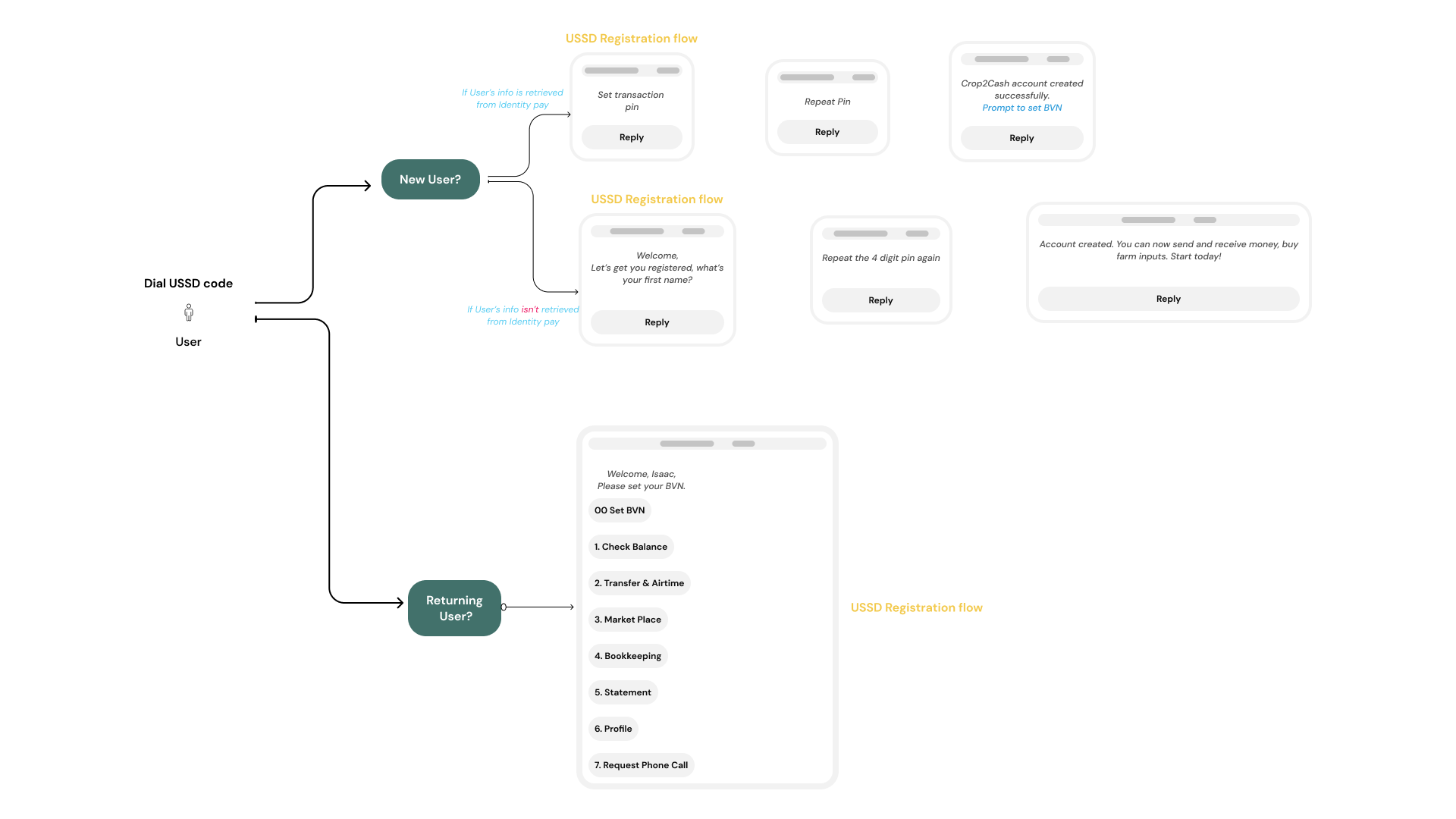

Onboarding Process:

To own an account in Nigeria, users need to undergo a basic KYC process. There are challenges with this; there is an existing trust issue in place; a lot of people are being scammed and robbed via their bank details, hence farmers in the age bracket will most likely frown at any process that requires these details.

So how do we develop an onboarding process that ensures trust and converts users?

First Solution: KYC

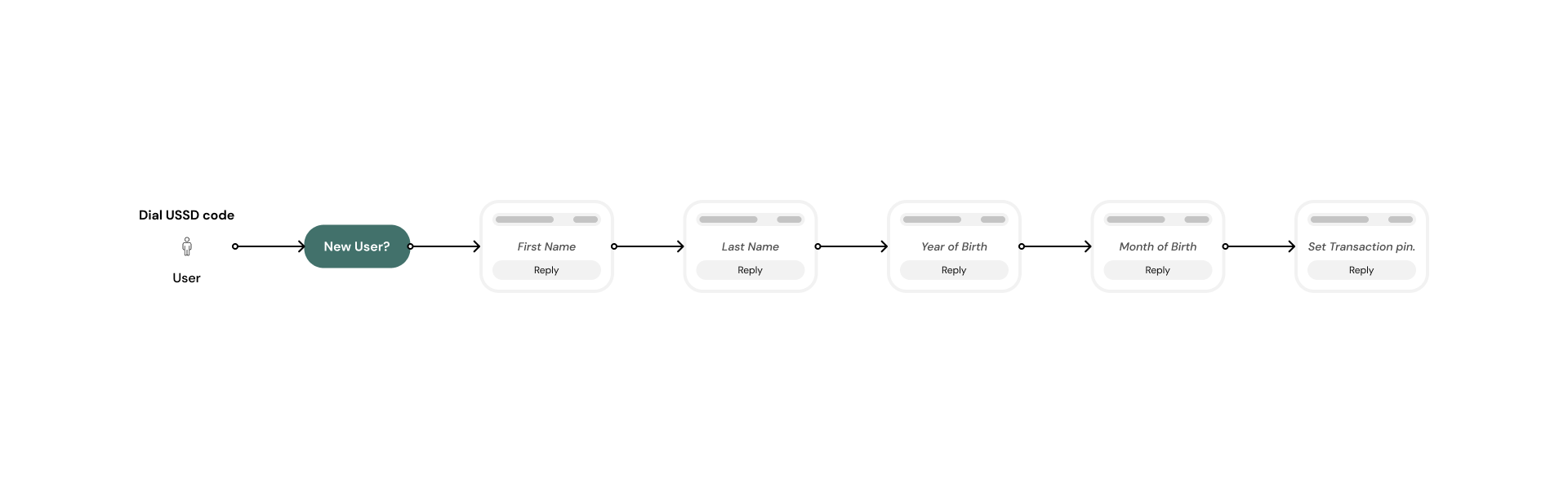

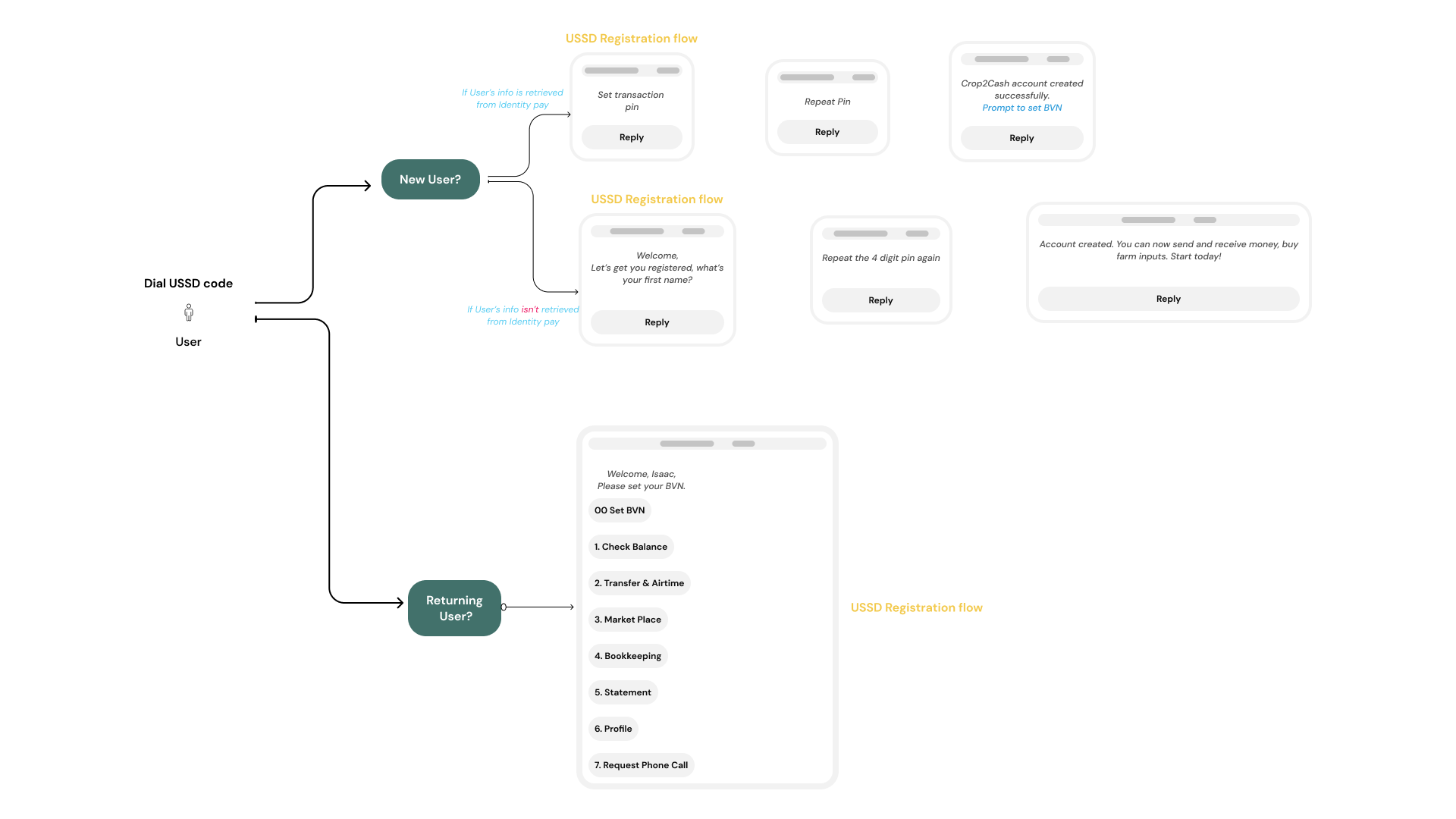

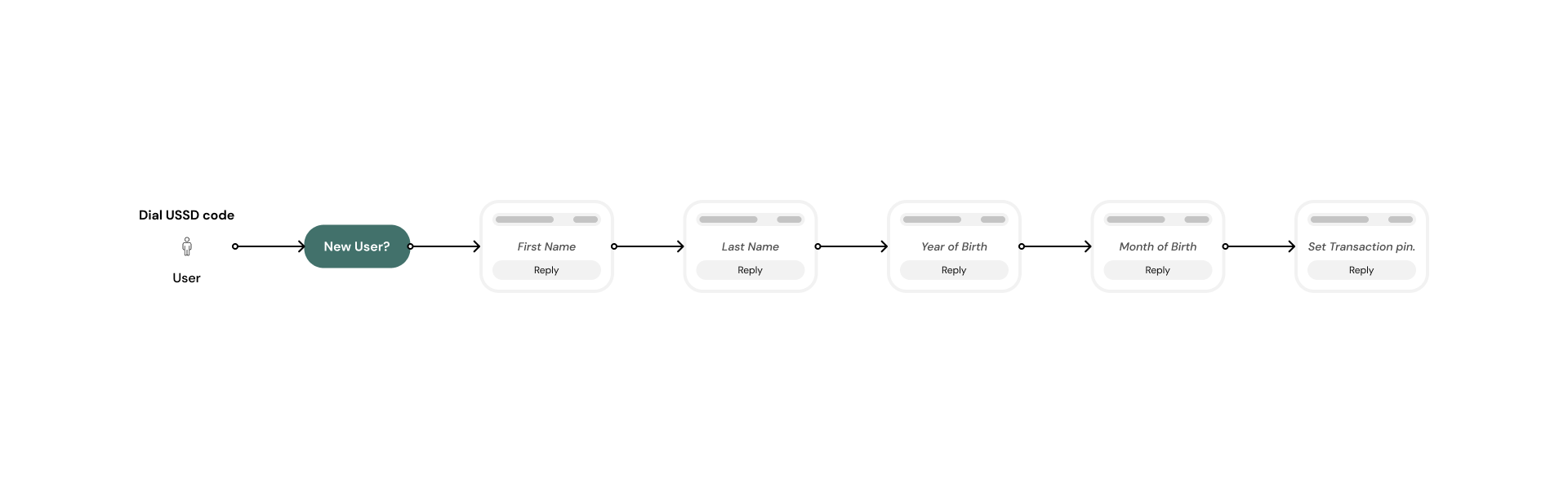

We built the product with the standard KYC and tested it with Users. While registering, users supplied:

Test Result:

Timeout issue; Every USSD requests times out after 20 secs of inactivity, we observed that 70% of users couldn’t go past the last name stage. Only 10% completed the registration.

Improvement

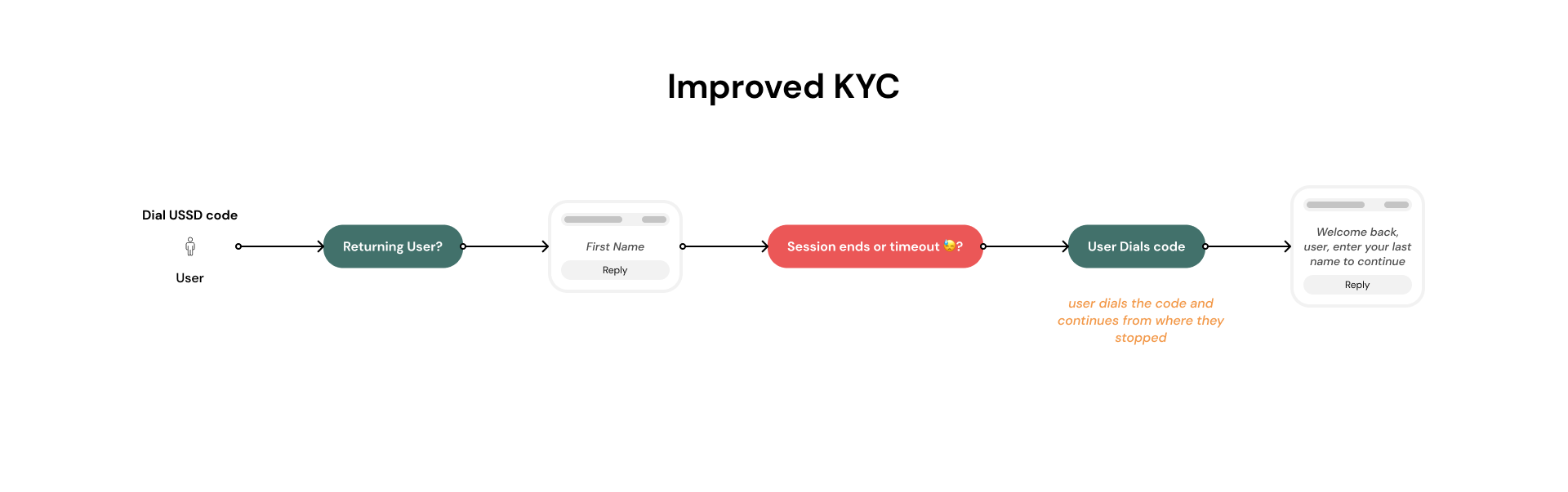

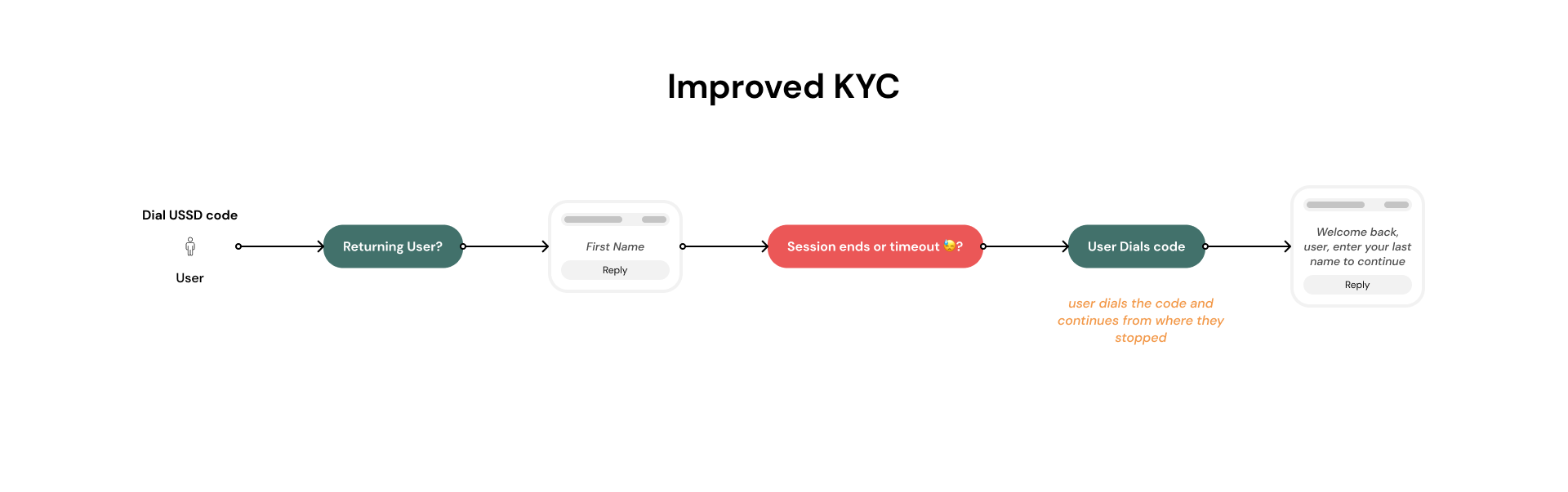

We Introduced Session storage/cache to enable users continue from where they stooped. So, if the user stops while inputing the last name or the session timed out, they continue from where they stopped whenever they dial the code

Test Result: 40% increase in registration completions.